Insurance is a minefield. You don’t want to spend too much, but at the same time, the last thing you want is to be under-insured and find yourself shelling out should the worst happen.

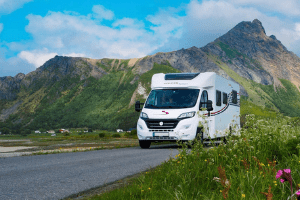

So, when it comes to insuring your motorhome, camper van or caravan, it’s crucial to do your homework to find the right policy for you and your lifestyle. One of the advantages of insuring your motorhome with Comfort Insurance is that many of the things that are added extras with other insurers are included as standard with our basic-level comprehensive cover.

That’s what appealed to motorhome owners Mary and John. “Our old provider gave us a quote that looked really good, but it didn’t include some of the things we need,” Mary said.

“When we added all those extras on top, it was really expensive. We like to go on trips outside the UK, but the insurer charged more for our Green Card, and we found we weren’t covered to go where we wanted, when we wanted.”

Mary and John switched to Comfort to insure their motorhome, because the policy covers unrestricted travel in Europe, with the Green Card valid for 365 days of the year. They added European breakdown cover into the mix, allowing them to see Europe at their leisure without a worry.

Additional benefits include £5k cover for personal effects and belongings, the full value of fixed awnings, up to £500 for your generator, new-for-old vehicle replacement*, specialist window/windscreen repairs or replacement, and gas explosion cover.

Campervan owners, too, can enjoy similar advantages when they buy Comfort insurance, and more besides – which proved lucky for 22-year-old Liam. He’d found it hard to get insured for his summer getaway with friends in his campervan because of his age, but Comfort was able to help where other providers couldn’t.

For caravans, Comfort policies include public liability insurance up to £2 million, as well as accommodation if an accident interferes with your holiday**. “We’d been caught out before, when we were left high and dry after our caravan was rear-ended,” recalled mum-of-three Sarah.

She and her husband had to fork out for hotels while the caravan was in for repairs during their family’s holiday. But now, with Comfort cover, that’s not a concern. Like all our customers, Sarah was able to take advantage of expert advice about what was included in her policy, and what optional extras would be useful – like breakdown cover, should they be caught off-road again.

That attention to detail, along with our unrivalled choice of policies, is what makes 98.97% of Comfort Insurance’s customers say they’re happy with our service and would recommend us to a friend***.

To find out more, call us on 0208 9840 666.

* up to three years and 15,000 miles to subject to policy term and conditions

** maximum £150 per day for up to 15 days [website says ‘minimum’]

*** April 2014